Handyman insurance

Join more than 5700 professionals in property maintenance similar to you. Compare the best insurance options from reputable brands.

Why would you require insurance for handymen?

Handyman handywoman, handyman and odd jobs expert. No matter how you describe your job every day is different. Installing a shelf or hanging a door in one minute and changing the tap next. Handling the weight of heavy equipment and materials. The risk of making mistakes and mishaps is part for the course. While they’re not preventable from happening, you can help protect yourself against the cost.

- Protection from large claims such as accidental injuries or damage

- The peace of mind for your business and your customers

- Make sure you have the insurance you require to be protected from legal fees, tools, or personal accidents.

What do handyman insurance policies cover?

We let you take charge as you are in control of what is important for you as well as your company. You may be concerned about injuries on the job or the theft of equipment and tools you utilize to manage the business you choose what you’ll include in your policy.

Public liability insurance for Handyman

If you or your team members accidentally harm someone or damage their property.

Insurance for public liability

A crucial kind of insurance coverage for the freelance handyman. When you’re working in and out of customers’ offices or homes all day long and day out, the chance of getting injured is significant. Even the most careful of employees cannot prevent every accident.

What is typically included in the general liability insurance?

Business claims against you to:

- Someone else is injured due to the work of your handyperson

- damage to property of someone else as a result of the work you’re performing, or due to your work

- accident or property damage that is that your employee causes (keep in mind that you need to have employer’s liability insurance if there is employees working for you. It’s an obligation under the law)

For instance:

- You replace a tap, but don’t tighten the fixture sufficiently, and the bathroom is flooded and the ceiling below requires repair.

- the shelves you’ve set on the floor earlier fall onto your customer as they’re in the couch which can result in a head injury.

- Your employee is helping you to replace a ball valve in your the toilet of a customer. They accidentally drop on the top of the tank onto the floor of the bathroom and cause the tiles to split

What do you need to add cover to protect

- specific work (such as making a bedroom, or fitting the kitchen or bathroom) If you are doing the same type of work regularly Handyman insurance is designed for general maintenance and odd jobs .

How much will handyman insurance cost?

Find out the amount you’ll have to pay by comparing prices from a variety of trustworthy insurance providers. You can choose the coverage that you want to include in your policy, ensuring that you only pay for the coverage you require.

How do I pick the right the best insurance?

Ensure that you have the appropriate kind and amount in company insurance could mean the difference between having an insurance claim settled and having to pay the cost of an accident on your own. Find our helpful tips on what you should consider when you purchase insurance.

What is the process of claiming?

Contrary to price comparison websites and other price comparison websites, we take the hassle from claims. We realize how important that it is for you to have your company back on track fast and with the least amount of stress. This is why you can have access to your own claims anytime, at any time of the day or at night. Contact them at 0333 207 0560 , or make a claim online. They’ll strive to be fair and helpful. The following figure is rounded over our wide range of products. Our claims process can differ depending on the product and operates according to a ‘claim-by-claim basis.

Handyman Insurance FAQs

No matter if you’re brand new to purchasing business insurance, or operating for a while, here’s the answer to the most commonly asked questions regarding handyman insurance. It is also possible to look over our questions about business insurance.

Can I purchase business insurance if I’ve been through some CCJs and IVAs?

Every insurer views CCJs and IVAs in a different way Some have more strict rules than others. However, being a victim of the status of a CCJ or IVA doesn’t mean that you’ll be unable to get insurance.

What is the difference between making payments Direct Debit and making a lump sum payment?

You are able to choose the type of payment that best suits your company and cash flow most effectively. Certain consumers prefer to settle their bills for their policy in one lump sum, while some prefer to settle for a regular monthly amount, just like you pay for many other charges. Simply Business offer three ways to pay for your insurance:

- one-off credit or debit card payment

- BACS payment

- Direct Debit When you opt to pay via Direct Debit (Direct Debit), our credit company, Premium Credit, pays Simply Business the full amount for the policy in advance. Then, you repay Premium Credit over the form of 10 installments per month.

Is it possible to change between sole traders to a limited company impact my insurance coverage?

If you alter your business’s legally from sole proprietorship to limited company halfway through your insurance policy, give us a phone call immediately at 0333 0146 683. We’ll take just only a few minutes to end the existing plan and replace it protects your new legal entity. It’s important to keep in mind that your insurance provider and price of your premium may have to be changed.

-

What kind of insurance do handymen require?

It’s a good idea start by conducting an analysis of the potential threats your company might be facing.

If you employ employees for you, legally you’re required to provide the insurance of employers’ liability..

If you’re involved with people in your job, public liability insurance is a crucial one to take into consideration too.

If you utilize any kind of specialist tools for odd jobs or property maintenance, you may consider purchasing protection for your tools. This is an important type of insurance that is required by the majority of self-employed handymen.

Other options for handymen and handywomen to think about include:

Do handymen require insurance?

If you employ employees on behalf of you, employers’ liability insurance is required by law.

It is not mandatory or legally bound to purchase additional insurance over this, however there are other insurances to think about if you’re looking to secure other parts of your company.

Can I add coverage for another profession or trade in my company insurance policy?

Yes. It is essential to ensure that you have the correct type and amount of insurance to cover the different kinds of work you perform. For instance, if you’re a plumber, then you could also be involved in construction work on specific tasks – you’ll require additional protection for this, however, you can get everything covered under one policy. Once you’ve started your quote, there’s the option of adding a different occupation or trade to the policy. If you’d like the addition of a new profession or profession, contact us at 0333 0146 683 and one of our experts can assist you in setting your policy in a matter of just a few minutes.

Do I have the option of adding coverage for another profession or trade in the middle of my policy?

Yes. You can begin offering services that require various skills or complete various tasks. If you’re in this position it’s crucial to contact us on 0333 0146 683 and update your policy prior to embarking on this new task. In the event that you do not have appropriate type of insurance that is appropriate for the job you’re doing, you could not be able to claim your insurance if you have a problem.

-

Is public liability insurance able to cover my company for the activities by my workers?

It will be contingent on the extent to which you have employers’ coverage for liability. The insurance policy is intended to safeguard your company from legal consequences arising from legal actions initiated by people for damages or injuries to their property. But in the event of your employees ‘ actions causing injuries or damages the protection is only available when you have employer the liability insurance.

If you hire people legally, you’re required to carry employers’ liability insurance.

There’s a caveat here. Family-owned businesses that aren’t registered as a limited corporation aren’t legally required to carry insurance for employers’ liability. The government defines”a “family firm” as one in which the employees of all employees are closely associated with you (as spouse or civil partner sibling, child grandparent, parent, grandchild (step-parent, stepchild, step-child and half-sibling). If you operate an unincorporated family-owned business and choose to not purchase insurance for employers’ liability It’s crucial to understand that your public liability insurance won’t provide protection against the harm or injury that is caused by your employees.

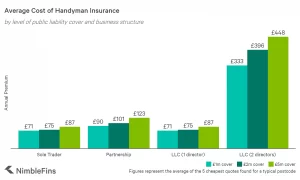

Cost Average of Handyman Insurance

The average price of general responsibility insurance is about PS75, which provides PS2 million in coverage to a handyman who is self-employed operating by himself (which is more that it is typical cost for sole trader insurance within the UK). But, the cost of insurance for handymen can increase by 10 times when you add additional coverages or hire employees.

For instance, a handyman insurance policy includes PS2 millions of liability insurance insurance, PS2,000 tool protection as well as personal injuries all-in insurance costs about PS230 per year. Employ one permanent employee, and this cost will go up to more than PS600 (if you have employees working for you legally, you’re required to carry Employers’ Liability Insurance that is expensive).

Cost of insurance for handymen (per year) Cover for public liability only (PS2 million) PS75 Public liability coverage with PS2,000 of tool insurance PS149 Personal injury coverage PS156 Personal injury liability, public liability and tool coverage PS230 Public liability for 1 employee as well as personal injury and tool protection PS616 How does tool coverage affect the cost of insurance for handyman?

Tools could cost thousands of pounds to replace in the event of their loss or stolen, or if they’re damaged accidentally that’s why many handymen choose an amount of tool cover. The greater the value of cover for tools and the more expensive the cost, but every additional PS1,000 of cover is less expensive to add.

For instance, the results in our study found that the initial PS1,000 of tool coverage increases by approximately PS60 (or PS65 if you keep the van in transit for a night) in the amount of the PS2m public liability insurance policy. The following PS1,000 of tool cover could add PS15 and PS20 to your premium and so on. The graph below shows the price for PS2m for public liability insurance and tools coverage for different levels of cover for tools.

What is the impact of personal injury coverage? impact the cost of insurance for handyman?

Our latest test of the market found that adding personal accident insurance on top of your handyman’s insurance policy would typically add about PS80 to the cost of your insurance.

For instance, the data revealed that for a sole trader who has PS2 million in public liability insurance the addition of personal injury insurance will increase their all-in cost from PS75 to PS155 increasing by PS80.

How does coverage affect the cost of insurance for handyman?

Another element that has an effect on price of the handyman insurance for business is the coverage level. The higher the limits of cover the greater the premium. But, an additional policy typically is less expensive per PS1 million than the initial PS1m of coverage.

For example, a single trader could pay PS71 to cover the initial PS1 million in handyman insurance for public liability and only PS4 for the subsequent million pounds of insurance. Below, you will see how the costs of handyman insurance rise with the coverage level and also across various business models.

The structure of your business also is a factor as well, with coverage costs more for certain kinds of firms. Particularly an LLC that has two directors will see the highest rate increase for coverage with higher levels as you can see in the above chart.

How do employees’ hiring decisions affect the insurance cost for handyman?

If you employ an employee legally, you’re required to ensure that employers’ liability protection in place, regardless of whether they’re familymembers, they’re paid in cash , and/or are working on a part-time or a full-time basis. The liability of employers can prove expensive which can raise your cost of insurance by five times or even more.

We found, for instance, that it costs around PS272 to add employer’s liability insurance to the self-employed handyman’s insurance.

Other variables that affect your handyman’s insurance rates

Numerous other factors could affect the cost of handyman insurance. For example, the location you work and live can affect costs by 20% or more.

In addition to additional protections such as employers liability, personal injury and tool coverage, certain companies require or choose additional protections, such as legal, stock, office and business equipment insurance. These can further increase your rates.

How to save money on Handyman Insurance

There are several ways to cut costs on the handyman business insurance. Be sure to examine quotes from several sources as rates may differ dramatically from one company to another. In our research, the estimates for an individual handyman having PS2m of public liability insurance was from PS68 up to PS179, which is a variance of 162 percent. Utilizing a comparison website can be beneficial in this respect by saving time and cost.

The second is that insurance companies may permit you to select an increased excess to provide a discount on your handyman insurance. However, an increased excess isn’t necessarily a wise choice. The reduction in premium is usually not much in comparison to the amount you’ll have be paying in case of a covered claim.

The third, and perhaps the most straightforward method of saving money on insurance for handymen is to pay annual (upfront) to cover the entire year. This could save you about 12.5 percent off the cost of business insurance for handymen every year.

Methodology

We began by collecting hundreds of quotes for insurance for handyman public liability to determine what the typical handyman will have to pay for the insurance. Then, we compared quotes based on various factors, such as the type of cover that are available as well as employees’ salaries, etc.

It is important to note that insurance quotes may differ significantly depending on the circumstances. Therefore, the cost of your insurance for business could be much more or less than the rates shown in this article. This information is intended to serve as a general guideline to learn more about the cost of handyman insurance and the various factors that influence insurance rates in general.